SEE Insurance (powered by SEE Business Solutions) has the goal of providing fantastic customer service when looking after you and your business’ insurance. We specialise in insurances required in the construction industry for complete coverage on any possible risks or liability that Builders, Trades and Suppliers are open to whilst conducting your day-to-day business activities.

We do whatever it takes to ensure we provide you with the best service, the best cover and the best rate, all whilst educating and assisting you with everything needed to achieve the best outcome.

We act as an intermediary between our valued clients and all major insurance companies. Our role is to help you assess your insurance needs and to find the most suitable insurance coverage that meets your specific requirements and where possible, save you money.

Here are some of the services that we provide:

We analyse your business or personal situation to identify potential risks that need to be covered by insurance.

We research insurance products from multiple insurance companies to find the best coverage options for you.

We compare different policies and coverage options to help you make informed decisions about the insurance products you purchase.

We will always negotiate with insurance companies on behalf of you to obtain the best possible rates and terms.

We assist you in the event of a claim, helping you navigate the claims process and ensuring that you receive fair compensation.

We can provide advice on risk management strategies to help you reduce your exposure to potential losses and mitigate risks.

We provide ongoing support, monitoring your insurance needs and updating your coverage as needed.

Trades Insurance is designed for businesses that provide skilled services or manual labour, such as carpenters, electricians, plumbers, and other tradespeople. It is also sometimes called contractor’s insurance. Trades Insurance typically includes a range of different types of coverage, which may vary depending on the specific policy and the needs of the business.

Some common types of coverage that may be included in a Trades Insurance policy are:

This covers the cost of damages or injuries that a business may be held liable for, such as property damage or personal injury claims made by third parties.

This provides coverage for the cost of damages or injuries that may occur to employees while they are working for the business.

This provides coverage for loss or damage to the tools and equipment used by the business.

This covers the cost of damages or losses that may occur as a result of professional negligence or errors made by the business.

Business package insurance is designed to provide a comprehensive package of coverages for businesses. It combines several different types of coverage into one policy, simplifying the insurance buying and management processes. This can be an important investment for businesses of all sizes, as it can provide protection against a range of risks and liabilities that may arise in the course of their operations.

These policies typically include several core coverages (which vary depending on a business’ specific needs) including:

This provides coverage for the physical assets of the business, such as buildings, equipment, and inventory.

This covers the cost of damages or injuries that the business may be held liable for, such as property damage or personal injury claims made by third parties.

This provides coverage for lost income or other expenses that may arise if the business is unable to operate due to a covered event, such as a fire or natural disaster.

This provides coverage for losses due to theft or other criminal acts committed against the business.

This covers the cost of damages or losses that may occur as a result of professional negligence or errors made by the business.

Depending on the policy, additional coverage options may be available, such as cyber liability insurance, directors and officers liability insurance, or employment practices liability insurance.

Worried about your liability on your developments?

Imagine being able to receive a 10 year structural defects cover. Now you can!

If you are a developer who opts for Latent Defect Insurance, you will have the peace of mind knowing your project and your clients are protected against any structural defects for a full 10 years after it is completed. This means that if any defects are discovered during this period, the insurance will cover the cost of repairs or damages, saving you from a potential financial burden.

It is only possible to obtain LDI before construction has begun; therefore, it is essential to contact us as soon as possible

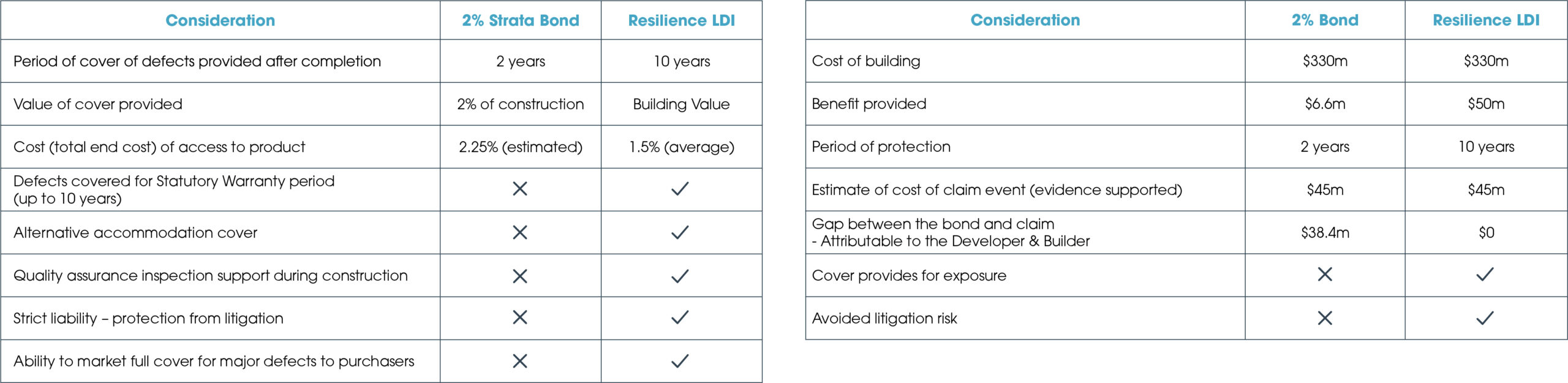

The tables below explain the differences between the 2% Strata Bond and LDI.

There are various factors that could contribute to the rise in your insurance premium since the previous year, some of the main reasons are:

It is crucial to find an insurance provider that offers the best pricing for your specific business needs. This is where SEE can assist you in locating the right one!

SEE Business Solutions stands out for our highly personalised and service-oriented approach. When you contact us, you can expect to speak directly with Matt, who specialises in addressing all of your insurance inquiries. Matt engages with our valued clients all day every day, assisting with their insurance requirements. Our primary goal is to secure the best rates for your insurance coverage. In fact, we are committed to beating the renewal price offered by your current insurer, and if we fail to do so, we’ll happily shout you a beer!

The team is run by our experts who live and breathe insurance everyday, whose philosophy is to make sure every builder gets the most hand held, personalised service possible. Whenever you contact SEE Business Solutions, you can be assured that you are speaking to the same people who understand your personal situation and business every time.

Give our team a call on 02 4039 8578 or fill in our enquiry form and we’ll be in touch.